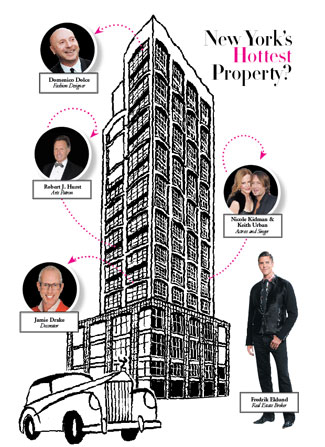

Architect Annabelle Selldorf’s 200 Eleventh Avenue apartment tower seems to have stolen some of the limelight from Robert A. M. Stern’s 15 Central Park West and Richard Meier’s Perry Street twins. The 19-story, 14-unit building in West Chelsea has attracted such diverse residents as decorator Jamie Drake (biggest client: Mayor Michael Bloomberg), fashion designer Domenico Dolce (who is rumored to have spent $29 million on two of its penthouses), former Whitney Museum of American Art co-chair Robert J. Hurst, and actress Nicole Kidman and singer Keith Urban, who have settled into a $9.6 million unit on the fourth floor. (It looks like Kidman, who’s obviously into name brands, abandoned her $8 million Meier-built 12th-floor condo on Perry for better river views; she currently rents it out for $45,000 a month.) On the less celestial side, Prudential Douglas Elliman broker Fredrik Eklund, a former porn star and a host on Bravo’s Million Dollar Listing New York, convinced fellow Swede and real estate titan Oscar Engelbert to buy a $5.95 million duplex on the fifth floor, although his associates Leonard Steinberg and Hervé Senequier are 200 Eleventh’s exclusive listing brokers. Steinberg, also a resident, is predictably smitten with his new address. “I hadn’t imagined living like this was possible in New York,” he says. “There are zero commercial entities on the ground floor—people come knocking, thinking we might be an art gallery.” The structure, comprising a base clad in gunmetal-glazed terra cotta and a tower of sculpted stainless steel, features 1,300- to 3,400-square-foot duplex layouts with 16- to 24-foot ceilings, wraparound terraces, and freestanding honed-granite tubs. Among the building amenities are a gym with an adjoining spin studio and a Sky Garage, which allows residents to drive into an oversize elevator that whisks them to private carports adjoining their digs. At press time, 200 Eleventh holds the record sales price for the neighborhood, with a recent purchase tallying $3,700-plus per square foot. —Allegra Muzzillo

illustration by tom backtell; eklund: Bravo Media; dolce, kidman AND urban: Shutterstock

istock

NEW YORK CITY

2012 FORECAST

Overall, the Manhattan real estate market closed out 2011 with a 12.4 percent decline in sales activity as compared to 2010—a significant softening, according to the Elliman Report, prepared by the independent appraisal firm Miller Samuel, Inc. The luxury market, too, which represents the top 10 percent of sales, or those totaling $2.975 million-plus, slowed by a similar amount. But the trophy market, the much-ballyhooed top one percent—or top 0.1 percent, really—is going gangbusters. “Right now, you have the best and all the rest,” says Miller Samuel’s Jonathan Miller.

At press time, ex-Citigroup CEO Sandy Weill is set to sell his penthouse at 15 Central Park West to Russian fertilizer billionaire Dmitry Rybolovlev for $88 million—which would make it the biggest deal in New York City history. (Broker Kyle Blackmon of Brown Harris Stevens has the listing.) Yet the Rybolovlev sale isn’t alone.

In the last year, developer William Lie Zeckendorf’s apartment at 15 Central Park West sold for $40 million, and financier Damon Mezzacappa’s apartment at 834 Fifth Avenue was picked up for $42 million by billionaire philanthropists Robert M. and Anne T. Bass. Both sales translated to roughly $10,000 per square foot, outstripping $7,000-per-square-foot yields at the height of the boom. Such stratospheric figures are in marked contrast to the top-tier luxury market of the last several years, when anti–Wall Street sentiment made it gauche to drop $30 million on a condo. Back then, some rare high-end properties eventually sold for about half of what they were asking, including Brooke Astor’s 15th-floor duplex at 778 Park Avenue [see “Astor Place Theater,” page 66] and a triplex penthouse at 812 Park Avenue. The Astor apartment was priced at $46 million in 2008, but billionaire hedge funder Daniel Sundheim and his wife, Brett, paid a relatively meager $21 million late last year.

With 2012 bonuses looking slim,Kirk Henckels, director of the luxury-focused Stribling Private Brokerage, doesn’t expect many acquisitions by the Wall Street crowd, which dominates the $5- to $10-million market. “But I do expect an increased number of old-money home-buyers looking for $20-million-plus marquee homes,” says Henckels, who has been showing his listings to foreign buyers and entertainment executives. “People don’t like being denied their toys for very long.” —Christina Lewis Halpern

WHAT THE RUDINS WROUGHT

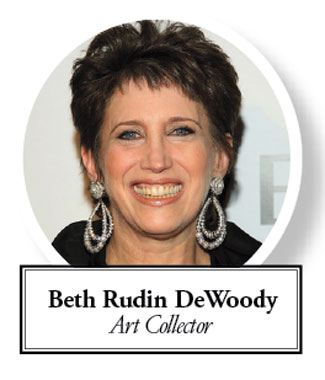

Buyers have snapped up nearly all of the apartments at One Thirty West 12, the refurbished 14-story former St. Vincent’s Hospital building. It’s great news for the Rudin family, one of New York’s oldest, most powerful commercial real estate developers, who are making their first foray into the condo market. The Rudins have waged a long, contentious battle to redevelop the shuttered St. Vincent’s complex, which is planned for 2015. But the controversy has not slowed sales at One Thirty, which opened for sales last fall. (Two still-available four-bedroom units are asking $5.75 million and $6.35 million, respectively.) The prewar detailing, huge layouts with multiple exposures, and sunken living rooms designed by Cook + Fox Architects created so much demand that “we raised prices eight times,” says Samantha Rudin, whose aunt, art collector Beth Rudin DeWoody, decorated the model apartments with dozens of pieces from her collection, including works by Franz Kline and Ed Ruscha. Stribling Marketing Associates is representing the building. —C.L.H.

holy macdougal, batman!

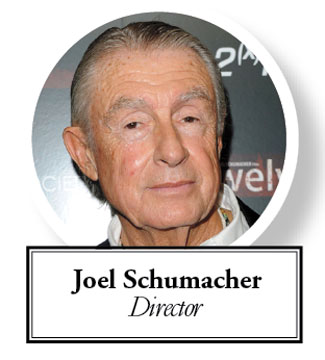

Veteran hollywood director (and native New Yorker) Joel Schumacher decamped for California 30 years ago, but he’ll soon be spending more time in the Big Apple. Though he already owns a 790-square-foot condo at 25 Fifth Avenue in Greenwich Village, the Batman filmmaker has paid $4 million (through a trust) for a three-bedroom apartment at MacDougal Lofts. Just off Washington Square Park, the landmark 1891 Romanesque Revival building features 10 modern units with open English-inspired kitchens designed by Smallbone of Devizes, radiant-heated wood floors, enclosed glass fireplaces, automated lighting, and in-ceiling Crestron sound systems. Julie Pham of Corcoran had the listing. —C.L.H.

you’ve got a friend?

The East Village was recently divested of a potential landmark building, thanks to former Friends actor David Schwimmer. Through an LLC, he reportedly shelled out $4.1 million for the five-story 1852 townhouse at 331 East 6th Street—the oldest on the block, between First and Second avenues. By demolishing itjust four months before it was eligible for historic status, Schwimmer incensed neighborhood preservationists. His plan for the site: a modern six-story home outfitted with an elevator and rooftop terrace. —A.M.

beth rudin dewoody, joel schumacher and David schwimmer: istock

the straight and narrow

Here’s the skinny on a celebrated townhouse in the West Village: At just 9½ feet wide and 30 feet deep (including the rear garden), the Millay house at 75½ Bedford Street is universally described as the narrowest abode in New York City—and it’s on the market.

Best known as the former residence of Pulitzer Prize–winning poet Edna St. Vincent Millay (actors John Barrymore and Cary Grant also once lived here), it’s being advertised as both a sale and a rental: Lease it for $13,500 a month, or buy it for $3.95 million—$550,000 less than its $4.3 million ask this past December. Built in 1850, the recently renovated 990-square-foot townhouse hardly seems claustrophobic, with three bedrooms, a balcony overlooking a private garden, four wood-burning fireplaces, and a washer/dryer. —Barbara Thau

WESTCHESTER & HUDSON VALLEY

ASTOR PLACE THEATER

When the late, great philanthropist Brooke Astor died in 2007 at the age of 105, her cherished country estate, Holly Hill, was put on the market for $12.9 million. The circa-1927 10,000-square-foot manse in Briarcliff Manor has the grandeur of Downton Abbey, with its Sister Parish–designed formal rooms, spartan servants’ quarters, and 65 acres of rolling, landscaped grounds. Astor bought the place as a widow, after her third husband, Vincent, left her with some $60 million and the assurance, “You’ll have fun, Pookie.”

A great deal has transpired in three years. In 2009, Astor’s son, Anthony Marshall, now 88, was found guilty of grand larceny for changing his ailing mother’s will and giving himself a retroactive $1 million raise for managing her finances (among other charges); he was sentenced to one to three years in prison, a conviction he’s still appealing. Holly Hill’s asking price was reduced to $7.5 million, and a Sotheby’s auction of Astor’s art and antiques is scheduled for April 19. Late last year, the property was purchased through an LLC for $6.45 million, half of its original ask. According to the buyers’ agent, Tracy Isaacs of Coldwell Banker in Scarsdale, they have no plans to subdivide or demolish. Word is that they had already been living in Westchester but needed more room for their two children.

Astor’s 778 Park Avenue co-op also recently sold at a steep discount, for less than half of its initial $46 million ask. A person close to the Westchester deal insists the Marshall scandal had nothing to do with the listings’ reduced closing prices. “There’s been a bit of a recession,” the source observes drily. (The Park Avenue place was reportedly a fixer-upper with a strange layout.) But another source familiar with the deal thinks it’s too great a coincidence that both properties closed at the same time, at half-price or less: “With the Marshall case tied up in court, the money will be held until a decision is made, though there are reports that Marshall is trying to line up funds—and fast.” —Diane DiCostanzo

ad exchange

The most curious thing about the $22 million listing of ad exec Sara Arnell’s Katonah home is who isn’t mentioned: her husband, Peter. A Wall Street Journal report indicates only that Sara is unloading the property, but the Arnell story is much more complicated. A one-time ad-industry boy wonder, the famously eccentric Peter founded the Arnell Group and sold it to the Omnicom global advertising firm in 2001. The couple bought the Katonah property from music mogul Tommy Mottola and his (now ex-) wife, Mariah Carey, for $18.3 million the same year, as a fun, family weekend place (the Arnells have three children). Just last year, Omnicom fired Peter, who quickly filed a lawsuit citing failure to return personal property in excess of $1 million; Sara then took over his role as CEO. The WSJ also reports that Sara put several million dollars into the 12,900-square-foot house, which has nine bedrooms, a conservatory, a three-story great room, a 20-seat home theater, and a kids’ cottage with a foosball table, arcade, and an ATV riding ring. Angela Kessel of Houlihan Lawrence in Bedford has the listing. —D.C.

feeling blue

Listed at $27 million, the 145-acre Sky Blue Farm is currently the highest-priced estate in Millbrook. Its owner, financier Bradley Reifler, CEO of Forefront Capital, bought the property in 2000 and spent a decade (and a reported $8 million) adding to the six-bedroom main house, as well as improving the grounds. Along with the main house, the property features a two-bedroom cottage and two-story guesthouse, a shooting range, an ice-skating rink modeled after Central Park’s Wollman Rink, tennis and basketball courts, a pool, gym, and spa, a 12-seat home theater, and an X Games–approved motocross track. And what would a farm be without horses? Buyers could mount their own cavalry with Sky Blue Farm’s 18-stall stable and indoor and outdoor riding rings. If it sells for anywhere near its ask, Sky Blue Farm will easily beat Millbrook’s highest-sale record of $15 million. Adam Hade of Houlihan Lawrence in Millbrook has the listing. —D.C.

DESIGNED TO SELL

Menswear and eyewear designer Jhane Barnes and her husband, textile-industry exec Katsu Kawasaki, just sold their five-acre Pound Ridge property for $2.1 million, down from an initial $2.395 million ask. The 1994 four-bedroom home overlooks a private pond and was restored with salvaged materials throughout, from bluestone on the exterior to window frames and siding sourced from reclaimed wine and olive barrels, respectively. Barnes and Kawasaki are heading north, to the Waccabuc area. Linda Finn of Houlihan Lawrence in Brewster represented the buyers; Michael Neeley of Ginnel Real Estate in Bedford Hills, the sellers. —D.C.

NASSAU COUNTY

GOOD AS GOLD

Long Island’s Gold Coast, famously dotted with turn-of-the-century estates and mini-mansions, has always maintained the rarefied, Roaring Twenties air so closely associated with F. Scott Fitzgerald’s ode to the North Shore, The Great Gatsby. Once home to wealthy families like the Astors, the Vanderbilts, and the Whitneys, the area still lures a choice mix of boldfaced names, Wall Streeters, and doctors drawn to its top-notch schools, waterfront properties, country clubs, and luxury shopping along Manhasset’s Miracle Mile.

Though the Gold Coast’s boundary is somewhat loosely defined, most brokers agree that it includes clusters of townships and hamlets including the Brookvilles, Centre Island, Cold Spring Harbor, Glen Cove, Kings Point, Laurel Hollow, Lloyd Harbor, Locust Valley, Matinecock, Mill Neck, Muttontown, Old Westbury, and Oyster Bay, among others.

By many accounts, the Gold Coast’s 2012 market has been looking up, most notably in sales of high-end properties, which is also characteristic of the past year. The Gold Coast saw four sales at or above $10 million in 2011, the highest being 39 Applegreen Drive, a 22,000-square-foot, eight-bedroom Georgian mansion in Old Westbury that sold for $15.9 million. “This year’s figures could even eclipse last year’s,” says Robert Olita, a broker with Prudential Douglas Elliman. With 2011 sales up 4.6 percent, the Gold Coast outperformed the Long Island market overall, which was down 4.9 percent. On the Island, the 2011 median sales price was $350,000, down 4.4 percent from 2010, whereas the median price of a Gold Coast property was $700,000, unchanged from the previous year. (The median sales price for upper-echelon Gold Coast properties was $1.4 million.)

The promising 2011 statistics can be attributed in part to the fact that “home prices dipped to a six-year low, which helped sales,” says broker Shawn Elliott of Shawn Elliott Luxury Homes & Estates. Consider media mogul Rupert Murdoch’s sale of his Michael Smith–designed 11-bedroom Colonial estate in Centre Island, which netted $9.1 million, down from $14.8 million. (Bonnie Devendorf of Daniel Gale Sotheby’s International Realty in Locust Valley had the listing.)

This year, an increase of foreign buyers—particularly from China and Russia—“accounts for many of the upper-tier purchases so far,” Olita says. Like most North Shore brokers, Devendorf has a hunch 2012 will be good for sales. “I’m optimistic,” she says. “It’s an election year, and most election years are pretty good.” So will one of the plums on the market, Cornelia Guest’s Old Westbury estate, finally pique some interest? Templeton, Guest’s 1924 brick mansion, has been waiting (and waiting) for a buyer. The Georgian-style home, which sits on 15.5 lush acres, hit the market in 2008 at $20 million and relisted for $8.9 million in January, after several incremental reductions during the last four years. With three greenhouses, ornate topiaries, and a 17-stall barn and paddocks, Templeton has hosted countless legendary figures, from Truman Capote and President Kennedy to Halston and Andy Warhol; Shawn Elliott in Woodbury has the listing. —B.T.

stranded in centre island?

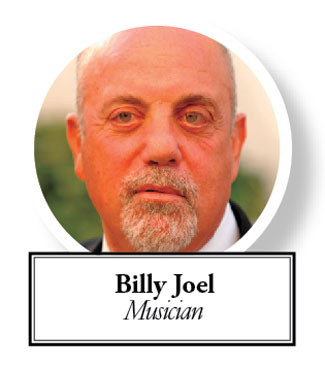

Centre Island, a village within the town of Oyster Bay, has long been known as the well-to-do’s peaceful alternative to the gridlocked Hamptons, counting musician Billy Joel and Fox network talk-show host Sean Hannity among its flashier residents. While Gold Coast sales in the $5-million-plus range rarely raise an eyebrow, certain townships in the region still seem to be feeling the lingering effects of a softened market—and word is that some Centre Island listings have been languishing. Lately, perceptive sellers have been chopping prices to avoid a curse of the white elephant. Case in point:

The Mayrock family, once co-owners of the Fortunoff retail stores, just reduced the asking price for Windrift, their sprawling 7,700-square-foot, five-bedroom European-style estate. With nearly six acres on Oyster Bay Harbor, including a guest cottage, tennis court, pool, and pool house, the home has been rolled back to $7.95 million from its original $12 million price tag. Barbara Candee of Daniel Gale Sotheby’s International Realty in Locust Valley has the listing. —C.L.H.

joel: Istock; hannity: Shutterstock